Benny Mantin is a professor of logistics and supply chain management at the University of Luxembourg. He is also the founding director of the Luxembourg Centre for Logistics and Supply Chain Management, also known as the LCL. The LCL, which is a member of the MIT’s SCALE network, offers graduate education, carries out cutting edge research, and closely works with industry on diverse projects in the broader domains of supply chain and operations management.

In his research, Prof. Mantin covers different aspects of supply chain management, dynamic pricing and revenue management, as well as transportation economics. His work has been published in numerous leading journals such as Marketing Science, Productions and Operations Management, the European Journal of Operational Research as well Transportation Research Parts A, B, and E. Benny Mantin is a board member of the Journal of Air Transport Management and the European Aviation Conference, among others. He has been engaged in consulting on air-transport policies, provided expert opinion in legal cases, and has appeared in the media providing insights on supply chains, the air transport market, and featuring the LCL. He was a visiting scholar at multiple academic institutions and held the Jean-Jacques Laffont Digital Chair on Digital Economy (at the Toulouse School of Economics). Given his expertise, he has led the Research Luxembourg, COVID-19 Task Force, Work Package 13: Supply Chains and Logistics.

Benny Mantin has been teaching diverse audiences—undergraduate, graduate, post graduate as well as practitioners—covering topics such as statistics, operations management, air transportation economics, pricing and revenue management, engineering economics, sourcing and procurement management, logistics management, advanced information systems and business analytics, and other topical domains. These courses were delivered to audiences in Canada, Luxembourg, Germany, Turkey, France, and Japan. Benny is involved in supervision of several PhD students. His graduates have secured jobs in academia (such as at Concordia University) and practice (such as directorship at a major insurance company).

Prof. Mantin was involved in numerous projects where he led students to improve processes at different firms. Prior to joining the University of Luxembourg in 2017, Prof. Mantin was a professor at the University of Waterloo, Canada. He received his Ph.D. from the University of British Columbia under the supervision of Daniel and Frieda Granot, and his M.Sc. as well as B.Sc. from Tel Aviv University.

Prof. Mantin is currently the head of the Research Committee of the Faculty of Law, Economics and Finance at the University of Luxembourg and he is an MIT research affiliate.

Below are some recent updates: research, teaching, projects

In 2021 I will be teaching a new PhD course on game theory in supply chain management. This exciting course will cover important fundamentals such as fixed point theorems (and their proofs), supermodularity, coalition formation and some refinements, such as the largest consistent set (LCS) and hopefully we will spend some time covering bargaining. I am glad to feature two of my academic siblings (Sanjith Gopalakrishnan and Dror Hermel) who will be guest speakers in this course!

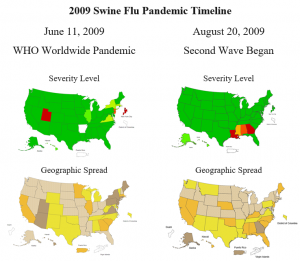

Consumer stockpiling and pandemics

How has consumer stockpiling of hand sanitizer evolved during seasonal flu epidemics and the Swine flue pandemic of 2009? Using data from 2008 to 2017 we study the changing patterns of sales, product assortments, and prices of hand sanitizer, and derive insights for retail operations and policy makers. We find that retailer strategies varied significantly among store formats. For example, during flu events, warehouse club stores increased prices and reduced product assortment for sanitizer products to a greater extent than other types of stores. Retailers appeared to learn from their pandemic experiences. During the second wave of the swine flu pandemic, retailers were prepared with greater assortments of sanitizer products, including large pack-sizes favored by consumers, compared to the first pandemic wave. Importantly, we find that price gouging laws appear to be either ineffective or redundant.

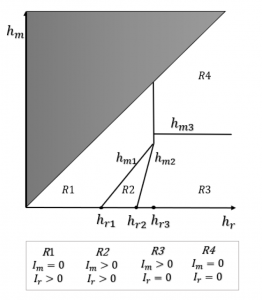

Who should stockpile inventory in a decentralized supply chain?

The seminal paper by Anand et al. (MS 2008) initiated the discourse on the retailer’s strategic benefit from holding inventory. They show that retailers may carry inventory strategically as a bargaining chip to induce the upstream manufacturers to drop the future wholesale prices. But will they still stock inventory when the manufacturer experiences a cost learning effect? The future cost of production reduces with the cumulative production in the early period. Such cost learning enables the manufacturer to benefit in the future by having a lower cost structure. Thus, she has an incentive to reduce the early period wholesale price to stimulate the demand from the retailer. However, such a demand stimulation bears the negative effect of allowing the retailer to stockpile further, potentially eradicating the manufacturer’s benefit from charging a higher initial wholesale price. Should the manufacturer raise the initial wholesale price to discourage the retailer’s strategic inventory and instead overproduce and stockpile on her own? This is a fundamental question: who should stockpile inventories in the supply chain – the upstream manufacturer, the downstream retailer, or both?

This is joint work with Ganesh Balasubramanian and Sachin Jayaswal from the Indian Institute of Management, Ahmedabad.

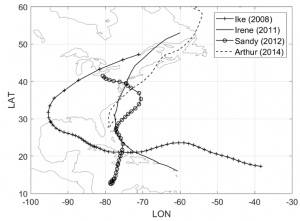

What drives consumers’ stockpiling habits in emergency situations and how do retailers cope and recover?

To study consumer precautionary stockpiling behavior prior to the onset of emergency events and determine the impact of this behavior on in‐store product availability for various formats of retail store outlets, we utilized retail scanner data before and after hurricanes from the US. We demonstrate how supply‐side characteristics (retail network and product variety), demand‐side characteristics (hurricane experience and household income), and disaster characteristics (hazard proximity and hazard intensity) significantly affect consumer stockpiling propensity hurricanes approach. We also study longer‐term impacts on retail operations and compare the performance of different retail formats. This paper, entitled “Pre‐Hurricane Consumer Stockpiling and Post‐Hurricane Product Availability: Empirical Evidence from Natural Experiments”, was cu-authored with Xiaodan Pan (Concordia), Martin Dresner (UMD) and Jun Zhang (NOAA) and published in Production and Operations Management.

To study consumer precautionary stockpiling behavior prior to the onset of emergency events and determine the impact of this behavior on in‐store product availability for various formats of retail store outlets, we utilized retail scanner data before and after hurricanes from the US. We demonstrate how supply‐side characteristics (retail network and product variety), demand‐side characteristics (hurricane experience and household income), and disaster characteristics (hazard proximity and hazard intensity) significantly affect consumer stockpiling propensity hurricanes approach. We also study longer‐term impacts on retail operations and compare the performance of different retail formats. This paper, entitled “Pre‐Hurricane Consumer Stockpiling and Post‐Hurricane Product Availability: Empirical Evidence from Natural Experiments”, was cu-authored with Xiaodan Pan (Concordia), Martin Dresner (UMD) and Jun Zhang (NOAA) and published in Production and Operations Management.

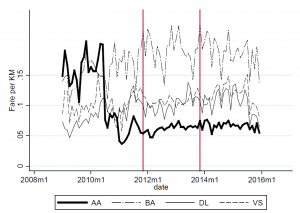

What happens to airfares when a US carrier goes bankrupt?

In the US, firms can enter bankruptcy protection under Chapter 11, a process that allows them to reorganize and restructure. The effects on fares are well documented in US domestic markets. But how do fares change in international markets, where European airlines, for example, cannot benefit from such a protection? Do they increase prices (as to reflect a less risky product) or do they drop prices (to push the US carrier into insolvency)? These fascinating questions have been addressed by our new article, entitled “Bankruptcy protection in airline markets: Does the impact vary in international and US domestic markets?” published in Transportation Research Part A.